Fibonacci code (FB code)

Automatically track the pullback price to your retracement target.

Fibonacci Retracement

Fibonacci retracement is commonly used by traders to find good entry points with a favorable risk-to-reward ratio. It calculates how much a trend has pulled back from the previous high to the current price. Common retracement ratios, such as 61.8% and 78.6%, are widely used in traders' daily routines.

Fibonacci code (FB code)

The FB code is designed to easily control the EA to enter the market at a specific Fibonacci retracement level. For example, in a buy order, after you set your target Fibonacci retracement ratio, the system continuously monitors the stop-loss and current highest price and dynamically adjusts the order to your target retracement ratio. The last decimal of the take-profit price is where you can enter the Fibonacci code (FB code). Please note, once the pending order is converted into a market order, the FB code loses its function.

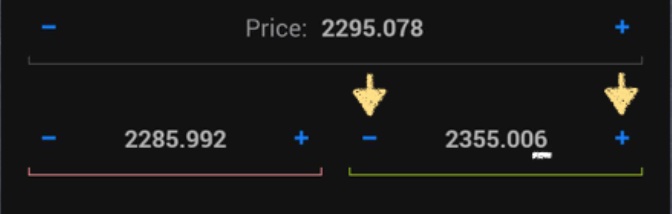

If you set an open price and stop-loss at certain levels and a take-profit price of 2355.006, the EA will interpret the last decimal, “6”, as the Fibonacci code. It will then automatically adjust the entry point (open price) of your pending order until the price reaches the retracement level (61.8% when the FB code is set to 6). To manage risk on your trade, both the open price and lot size of the pending order will be automatically adjusted.

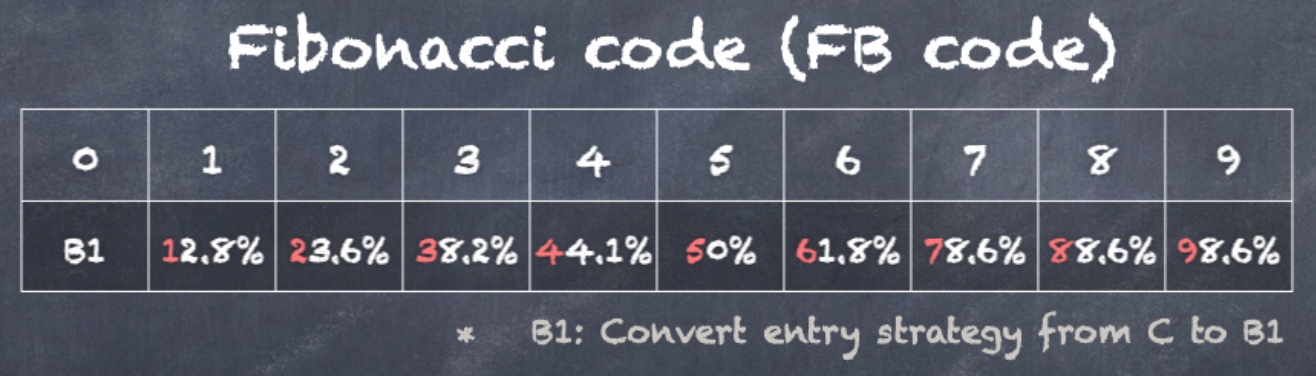

Below is the mapping table between the FB codes and their corresponding retracement levels:

| Fibonacci code(FB code) | Retracement level |

|---|---|

| 0 | Convert ticket from C to B1 |

| 1 | 12.8% |

| 2 | 23.6% |

| 3 | 38.2% |

| 4 | 44.1% |

| 5 | 50% |

| 6 | 61.8% |

| 7 | 78.6% |

| 8 | 88.6% |

| 9 | 98.6% |

What retracement ratio to trade?

Choosing a retracement level below 50% is often ineffective because it doesn't offer a favorable risk-to-reward ratio. Therefore, we generally recommend trading with a retracement level above 61.8%. So, why not always trade at the 100% retracement level? The reason is that it would reduce the frequency of entry opportunities, as the market doesn’t often pull back to such a high level. Some believe that the stronger the trend, the less likely the price will pull back to a deep retracement level. Trading with a retracement level around 61.8% can be a good compromise, offering both a favorable risk-to-reward ratio and more frequent opportunities to enter the trend. Depending on your trading style, you can choose the pullback level where you want to enter the trend.

| Opportunity to enter | Risk-to-reward ratio | |

|---|---|---|

| Low pullback level | HIGH | LOW |

| high pullback level | LOW | HIGH |

You can adjust the Fibonacci code by tapping the + and - buttons next to the stop-loss price on your MT4 app and clicking the Modify button.

We suggest first placing the Fibonacci indicator on the chart to identify the location where you want to enter. After that, we recommend setting the FB code to 9, which will locate the pullback at 98.6%, extremely close to your close-price stop-loss. This allows you to check if the close-price stop-loss has been set correctly. Gradually adjust the last decimal using the + or - buttons (close to your take-profit price being displayed) to match the entry point you desire. By doing so, you will have more time to confirm whether this is the exact pullback ratio where you want your ticket to be opened.

Conversion of Ticket from C to B1

FB code 0 is a special code. By sending an FB code of 0, you can stop the ticket from being in Fibonacci retracement mode. In other words, it converts the ticket from a [C] Fibonacci pending order to a [B1] simple pending order. After converting from C to B1, the open price of your ticket will no longer be dynamically adjusted. Please note, if you want to reverse the conversion and switch the ticket back to Fibonacci retracement mode (B1 to C or A to C), simply send any arbitrary take-profit price with the FB code set between 1 and 9. This will restart the pullback ratio tracking. Spend some time familiarizing yourself with it, and you’ll find it useful for your daily trading.

The short answer: Let go of this entry point and wait for another opportunity. It happens all the time. We can't predict the market; we can only make good decisions to enter with a favorable risk-to-reward ratio. So don't worry about missing one opportunity—there will always be another. 😊

If you find that the entry opportunity is gone, you will need to manually close the pending order yourself. The Fibonacci retracement tool won’t close your order for you; it will continue to track and calculate the entry position based on the distance between the stop-loss and the current highest point.