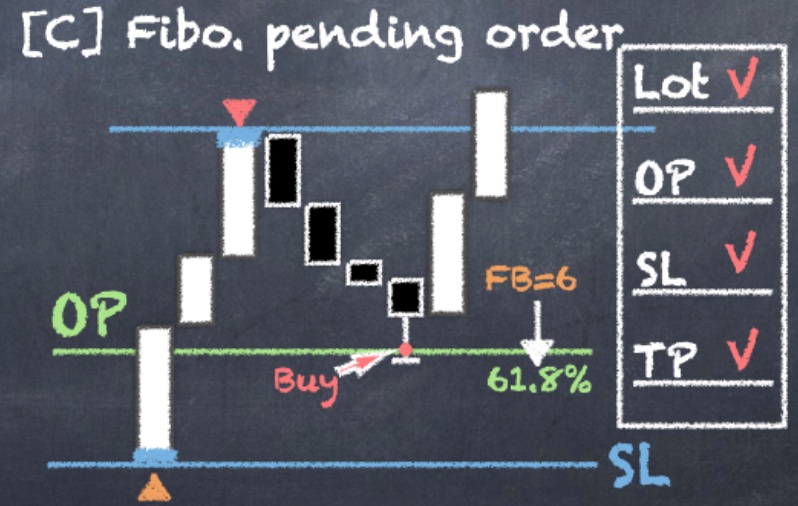

[C] Fibonacci pending ticket

Enter the ticket at a specific retracement ratio with automatic lot size calculation.

- OP: Set the open price anywhere between the current market price and your stop-loss.

- SL: Set the close-price stop-loss with the time frame code in the last decimal.

- TP: Set the FB code at the take-profit price to the specific retracement ratio.

What is the goal of this tool?

This tool is designed to help you automatically enter the market at your desired Fibonacci retracement level, reducing the need for constant chart monitoring. It’s ideal for entering during trend pullbacks. Fibonacci pending ticket are perfect for traders who want to enter when prices dip close to their stop-loss level. Instead of constantly checking your phone for opportune pullbacks, this tool does the work for you.

How does this feature works?

It enables you to enter the market when the trend retraces to your chosen Fibonacci level. For example, if you want to enter at a 61.8% retracement during a new uptrend, simply set a pending Fibonacci retracement order. Using our stop-loss and wave-tracking algorithm to locate the highest and lowest prices in the monitored time range, the tool continuously adjusts the entry price and lot size until it reaches your target. Once set, you only need to check occasionally while the prices approach your pending order.

EURUSD pending buy ticket with a stop-loss at 1.08539 with M5 timeframe, and enter at a Fibonacci retracement of 61.8%.

- Ensure the lowest price of the stop-loss is within the 60 most recent (closest) bars of the specified timeframe (for stop-loss bar time point searching).

- OP: Set the open price to any value between the stop-loss and the current market price.

- SL: Floor the price from 1.08539 to 1.08530 and add the M5 time frame code to get 1.08532.

- TP: Set the take-profit to 9.00006, where the last decimal represents the retracement of 61.8%.

EURUSD pending sell ticket with a stop-loss at 1.04231 with H4 timeframe, and enter at a Fibonacci retracement of 78.6%.

- Ensure the highest price of the stop-loss is within the 60 most recent (closest) bars of the specified timeframe (for stop-loss bar time point searching).

- OP: Set the open price to any value between the stop-loss and the current market price.

- SL: Ceil the price from 1.04231 to 1.04240 and add the H4 time frame code to get 1.04246.

- TP: Set the take-profit to 0.00007, where the last decimal represents the retracement of 78.6%.

There is actually a simpler way to set a Fibo pending order by only setting the open price and FB code (which means you can skip filling in the stop-loss). It's simply an [A] → [C] conversion ticket. Think of it as converting a simple pending order [A] directly into a Fibo pending order[C] by providing the FB code. It sets the close-price stop-loss and the time frame based on the open price. The tool calculates the retracement price based on the distance between the close-price stop-loss and the current high/low. Give it a try, and you might forget everything we just taught you above! 🥳

It happens all the time. We can't predict the market, but we can help you enter with a better risk-to-reward ratio. Take a buy ticket as an example: when the price doesn’t pull back and keeps creating new highs, the pending Fibonacci retracement won’t close your order. Instead, it continues to track and calculate the entry position based on your stop-loss and the rising highest point. In this case, you’ll need to close the pending ticket manually. Don't worry about missing one opportunity; there will always be another.

The best times to place a buy/sell order using a pending Fibonacci retracement are:

- After a new high/low is established in the market, providing clearer points for the tool to accurately identify the retracement level, or

- Following a breakout of at least 3–4 bars from your stop-loss. This reduces sensitivity to minor price fluctuations, allowing the algorithm to track the high point more steadily, potentially resulting in a more favorable entry position.